Introduction

In the evolving world of online trading, platforms that offer flexibility, innovation, and accessibility stand out. Deriv, previously known as Binary.com, has positioned itself as one of the leading brokers offering a variety of trading options, including CFDs, binary options, synthetic indices, and more. Since its inception in 1999, Deriv has grown to become a go-to platform for retail traders looking for an intuitive, reliable trading experience.

This review will cover all aspects of Deriv’s services—exploring its features, trading tools, platforms, asset offerings, fees, and more—providing you with the essential information to help you decide if Deriv is the right trading platform for you.

1. Overview of Deriv

Deriv Ltd. is a global online trading broker that has been operational since 1999. Initially known as Binary.com, the platform’s name was rebranded to Deriv in 2020, reflecting its expansion beyond binary options into offering a diverse range of financial instruments.

Deriv operates under several licenses, including those from the Malta Financial Services Authority (MFSA) and the Vanuatu Financial Services Commission (VFSC), providing traders with a reasonable level of regulatory security, though the platform’s regulatory status can vary depending on the country. Deriv’s mission is to offer retail traders access to a variety of markets with a high degree of flexibility, innovation, and risk management.

2. Key Features of Deriv

Before delving into specific offerings, let’s outline some of the defining features that make Deriv stand out in the crowded world of online brokers.

a) Variety of Assets

One of the key advantages of Deriv is its diversity in trading assets. Traders can access:

- Forex Pairs: Major, minor, and exotic pairs.

- Stocks & Indices: CFDs on global stocks like Apple, Google, Amazon, and major indices like the S&P 500 and Nasdaq.

- Commodities: Instruments like Gold, Silver, and Oil.

- Cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), and others.

- Synthetic Indices: Deriv’s proprietary synthetic indices, which are unique to their platform.

b) Multiple Account Types

Deriv offers different account types to cater to both beginners and advanced traders, with a relatively low minimum deposit requirement starting at just $5.

c) Advanced Trading Platforms

Deriv provides access to several powerful platforms, including DTrader, DBot, SmartTrader, and MetaTrader 5. Each platform is tailored for different types of traders—whether you’re a beginner looking for simplicity or an experienced trader seeking advanced tools and charting capabilities.

d) Leverage and Risk Management

Deriv offers high leverage (up to 1:1000 for forex traders), which can amplify both profits and losses. While this is an advantage for advanced traders, it can be risky for beginners.

3. Platform Offerings

Deriv offers several platforms, each tailored for different types of trading. Here’s a breakdown of the platforms available:

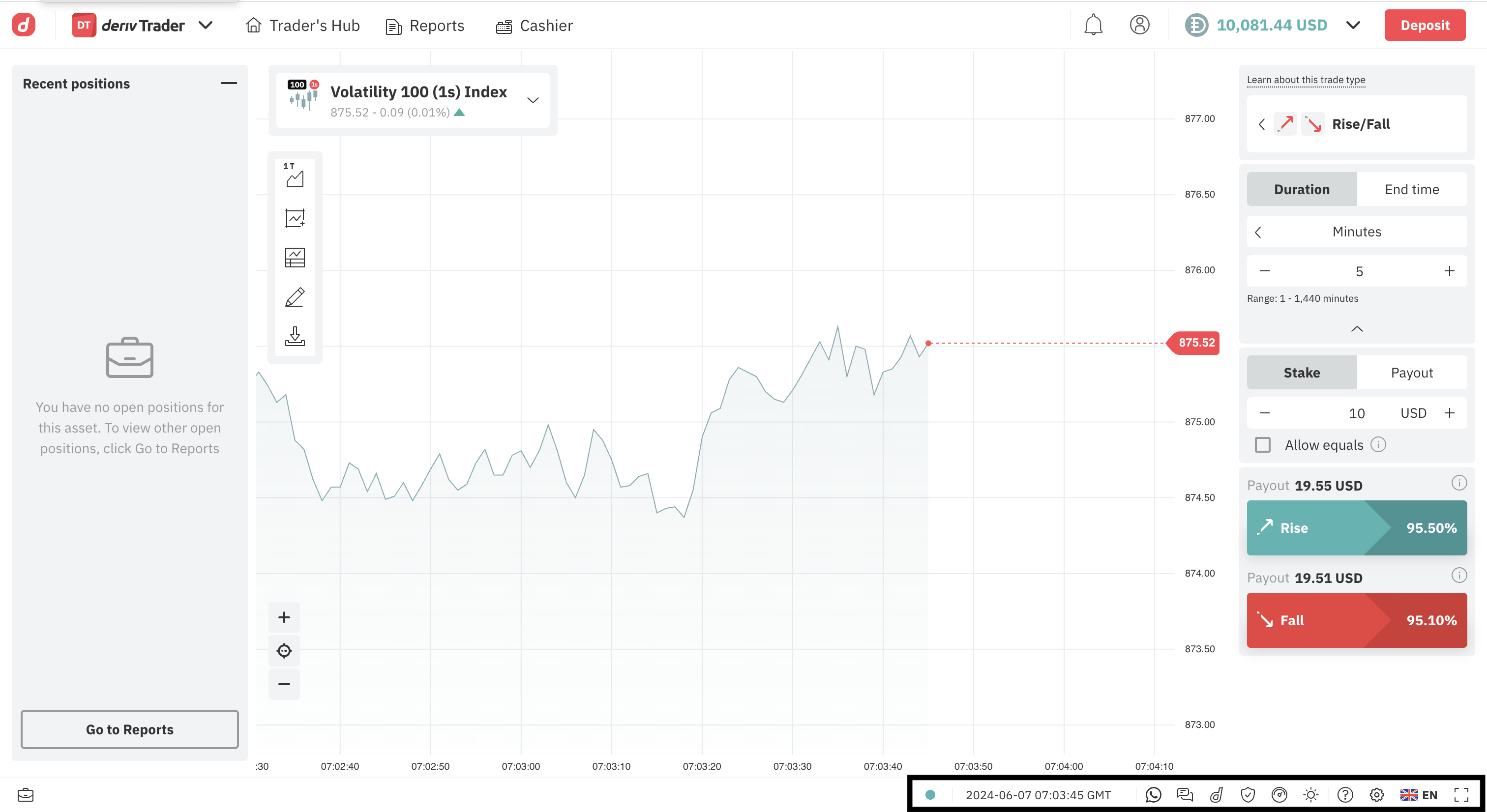

a) DTrader

DTrader is Deriv’s flagship platform, primarily designed for binary options and synthetic indices. It offers a straightforward, user-friendly interface with customizable timeframes, asset selection, and risk management features.

Features:

- One-click trading.

- Customizable charts.

- Multiple expiry times for binary options.

- A wide selection of synthetic indices.

- A demo account to practice risk-free.

b) SmartTrader

SmartTrader is the platform for more experienced traders who require advanced charting tools and trading features. It’s best suited for those who wish to trade synthetic indices, options, and CFDs.

Features:

- Advanced technical analysis tools.

- Multiple chart types (candlestick, line, OHLC).

- Various order types including limit and stop orders.

- Comprehensive risk management tools (stop-loss, take-profit).

- Multiple timeframes for in-depth market analysis.

c) DBot

For traders interested in algorithmic trading, DBot allows users to create automated trading bots without any coding knowledge. Using a drag-and-drop interface, traders can design bots to execute trades based on pre-defined rules.

Features:

- No coding required.

- Pre-set trading strategies or create your own.

- Automate trading based on specific conditions.

- Backtest your bots with historical data.

d) MetaTrader 5 (MT5)

For forex traders, MetaTrader 5 is one of the most widely used platforms worldwide. It provides advanced charting features, automated trading via Expert Advisors (EAs), and a wide array of technical indicators.

Features:

- Advanced charting with customizable indicators.

- Automated trading with Expert Advisors (EAs).

- Wide range of timeframes and order types.

- Market depth and one-click trading.

- Multiple order execution modes (instant, market, pending).

4. Assets Available for Trading

a) Forex Trading

Deriv offers forex trading through CFDs, with a wide selection of currency pairs, including major, minor, and exotic pairs. Forex traders can take advantage of leverage to potentially magnify profits, although high leverage can also increase the risk of significant losses.

Popular Currency Pairs:

- EUR/USD

- GBP/USD

- USD/JPY

- EUR/GBP

- USD/CHF

b) Stocks and Indices

For stock traders, Deriv offers CFDs on major global stocks and indices. This allows you to speculate on the price movements of stocks like Apple, Tesla, and Amazon, or trade market indices such as the S&P 500 or FTSE 100.

c) Commodities

Deriv provides CFDs for trading commodities like:

- Gold and Silver.

- Oil (Brent and WTI).

- Natural Gas.

These instruments allow traders to hedge against inflation, political instability, or fluctuations in global demand for raw materials.

d) Cryptocurrencies

With the rise of digital currencies, Deriv offers several popular cryptocurrencies for CFD trading. Traders can speculate on the price movements of:

- Bitcoin (BTC).

- Ethereum (ETH).

- Ripple (XRP).

e) Synthetic Indices

One of the platform’s unique offerings is its synthetic indices. These assets are designed to behave like real-world markets, but they are not based on any underlying real-world asset. This gives traders access to high volatility and continuous market hours, as synthetic indices are available 24/7.

Popular synthetic indices include:

- Volatility Index (VIX).

- Crash & Boom indices.

- Step Index.

5. Account Types and Minimum Deposit

Deriv offers multiple account types to suit various trader profiles. The platform supports accounts with different deposit requirements, starting from as low as $5.

a) Real Account

- Minimum deposit: $5.

- Access to all financial instruments and products available.

- Different leverage options depending on the asset class.

- Suitable for both new and experienced traders.

b) Demo Account

Deriv offers a free demo account with virtual funds that allows beginners to practice trading without the risk of losing real money. It simulates the live market environment, helping traders become familiar with the platform’s tools and features.

c) Islamic Account

For traders who follow Islamic finance principles, Deriv provides an Islamic account. These accounts do not incur swap fees or interest, making them Sharia-compliant.

6. Leverage and Margin

Deriv offers flexible leverage options, which depend on the type of instrument being traded. For example, traders can access leverage up to 1:1000 on forex pairs. This means that for every $1 of your own capital, you can control up to $1000 worth of currency.

While high leverage can magnify profits, it also significantly increases the potential for loss, especially if a trader is inexperienced. As a result, it’s important to use proper risk management techniques, such as stop-loss and take-profit orders, when trading with high leverage.

7. Deposits and Withdrawals

Deriv offers a wide range of payment methods for deposits and withdrawals. These include:

- Credit/Debit Cards: Visa, MasterCard.

- E-wallets: Skrill, Neteller, WebMoney.

- Cryptocurrencies: Bitcoin, Ethereum, etc.

- Bank Transfers: For larger withdrawals.

Deposits are usually processed instantly, while withdrawal times can vary depending on the payment method. Bank transfers might take several business days, while e-wallet withdrawals are often quicker.

8. Fees and Spreads

One of the most crucial aspects of any trading platform is the fee structure, and Deriv’s spreads are relatively competitive, though they can vary depending on the market and the asset being traded.

- Forex Spreads: Deriv offers spreads starting from 0.5 pips for major currency pairs, though spreads can widen during periods of high volatility.

- Cryptocurrency Spreads: These tend to be a bit higher due to the volatility of the crypto market.

In addition to spreads, there may be fees for certain payment methods, especially for withdrawals, though they generally remain competitive compared to other brokers.

9. Customer Support

Deriv offers 24/7 customer support, which is crucial for a global trading platform. The platform provides support through multiple channels, including:

- Live Chat.

- Email.

- Phone Support.

Their support team is generally responsive, offering solutions to a wide range of queries, from platform issues to trading concerns. Additionally, there is a comprehensive FAQ section on the website, which addresses many common queries.

10. Conclusion

Deriv stands out as a comprehensive, user-friendly trading platform suitable for both new and experienced traders. It offers a wide array of trading instruments, flexible leverage options, and multiple platforms to meet diverse trading styles. While it provides many advantages, particularly with its synthetic indices, traders should be aware of the potential risks involved with high leverage and the platform’s limited educational content.

If you’re looking for an innovative and flexible trading platform that offers 24/7 trading opportunities and a variety of assets, Deriv could be a great option. However, as with any trading, it’s essential to understand the risks and ensure proper risk management strategies are in place.